When I visited my accountant a few days ago, we spent the whole afternoon talking about his favourite subject…

Apple…

Yes, my accountant Brian has an insane love affair with the world’s most popular Tech company. Apple is the only product he uses, the only stock he invests in and the only stock he likes trading during the day.

When I reminded him that the Android phone markets like Samsung are not that far behind, he quickly stopped me short.

“So what?” He said while pointing to his iPhone. “Apple is a quality company. There is nothing like it out there! It will stand the test of time. Other stocks won’t.”

I found it hard to disagree with Brian. However, he admitted he was a bit nervous and here’s why…

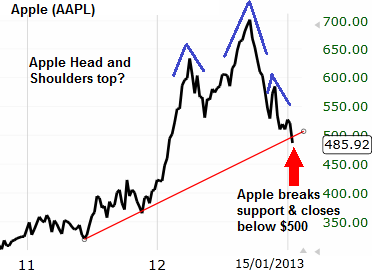

Yesterday Apple did something it has not done since February 2012. Take a look at this chart:

Apple closed below $500 for the first time in 12 months. Not only that, but it also broke a key support level as shown by the upward trendline (red line). This break of support is a bearish (negative) sign for Apple.

Apple made its highs in September at $700 – on the day the iPhone 5 was introduced. Since then it has been slaughtered. A near 30% drop till today.

So why was Apple getting destroyed?

One of the reasons put forward was that hedge funds were getting hit with margin calls.

The other more plausible reason was that most funds had made their money in Apple (doubling their returns) and could not see any further growth in the stock. So now they wanted to sell.

On Tuesday one analyst cut down his earnings forecast for Apple based on poor sales of the iPhone 5.

Whatever the reasons, the next earnings report for Apple is on January 23rd. A lousy report could send Apple’s shares in to a deeper free-fall.

However, not everyone is worried as this chart shows:

The above chart which measures how many option traders are long and short on Apple, shows option traders are still optimistic – but not excessively optimistic – on the Apple recovery.

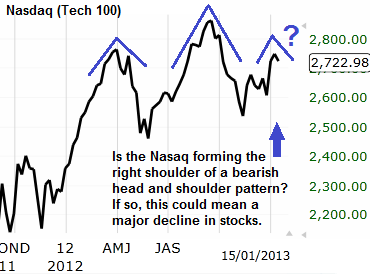

For me personally, I think it is worth watching the chart of the Nasdaq (the index of the top 100 tech stocks) for a major warning:

It seems the Nasdaq wants to form a bearish “head and shoulders top” pattern. This is a negative sign for stocks…

Could Apple’s decline be just an early sign of more bad things to come on the Nasdaq and other major stock markets? Only time will tell and January’s Apple results may reveal the answer.